New Delhi: Finance Minister Nirmala Sitharaman asserted on Tuesday that the government is using all borrowed funds to finance successful capital expenditures and to create capital assets, claiming that no amount of money was being deducted from any of the capital expenditure accounts.

In her reply to the Lok Sabha resources discussion, Sitharaman stated that” Govt intends to apply approximately 99 % of borrowed sources to finance successful capital expenses in the upcoming season 2025-26.” She stated that the fiscal deficit and efficient investment expenses were 4.3 % of GDP in 2025-26, which indicated that government spending was geared toward building cash assets.

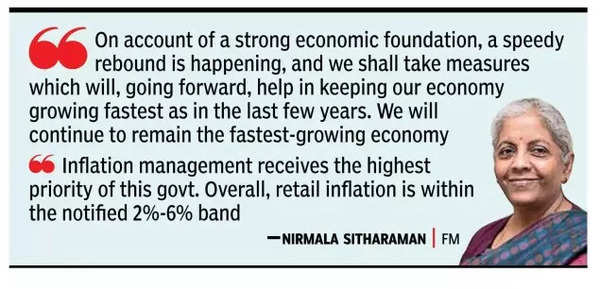

FM also said that the pattern of inflation, particularly meals, appeared to be moderating. The government gives prices managing the top priority, they say. Nevertheless, retail prices is within the notified 2%-6 % band”, Sitharaman said.

FM stated that the business was “recovering quickly” from the 5.4 % that the government had experienced during the current fiscal year and that it would take every precaution to maintain the country’s position as the world’s largest economy.

” On account of a solid financial base, a rapid rise is happening, and we may take steps which did, going forward, help in keeping our business growing fastest as in the last few years. We may continue to remain the fastest-growing economy”, FM said, adding that the secret last use consumption is estimated to grow by 7.3 % in the current fiscal year, riding on powerful remote need. In light of global challenges and geopolitical tensions, the Indian economy is projected to grow by 6.4 % in the current fiscal year.

Sitharaman added that a number of domestic and international factors are influencing the value of the rupee against the US dollar. He provided detailed data showing that the Indian rupee declined by 3.3 % against the US dollar between October 2024 and January 2025, but the decline has been less than compared to other Asian currencies. The South Korean Won and the Indonesian Rupiah had depreciated by 8.1 % and 6.9 %, respectively, during the same period while all G-10 currencies had depreciated by over 6 % with euro and British Pound sliding by 6.7 % and 7.2 %, respectively.