Donald Trump, the president of the United States announced sweeping new tariffs on imports from Mexico and China, a move that has triggered sharp reactions from global leaders and financial markets. The tariffs, which Trump says are aimed at protecting American workers and industries, have sparked fears of economic retaliation from affected countries.

Stock industry responded with considerable drops, while company officials expressed concern about rising costs for consumers. Trump remains angry, insisting that the “pain” may be worth it in the long run.

Poll

What Do You Believe the New Tariffs ‘ New Tariffs ‘ Will Have the Most Significant Effect?

Although the tariffs are intended to safeguard British businesses and workers, they raise concerns about possible economic reprisals, rising consumer prices, and long-term effects on global trade.

Below are 10 key insights from the latest innovations:

Canada, Mexico, China reveal counter-measures

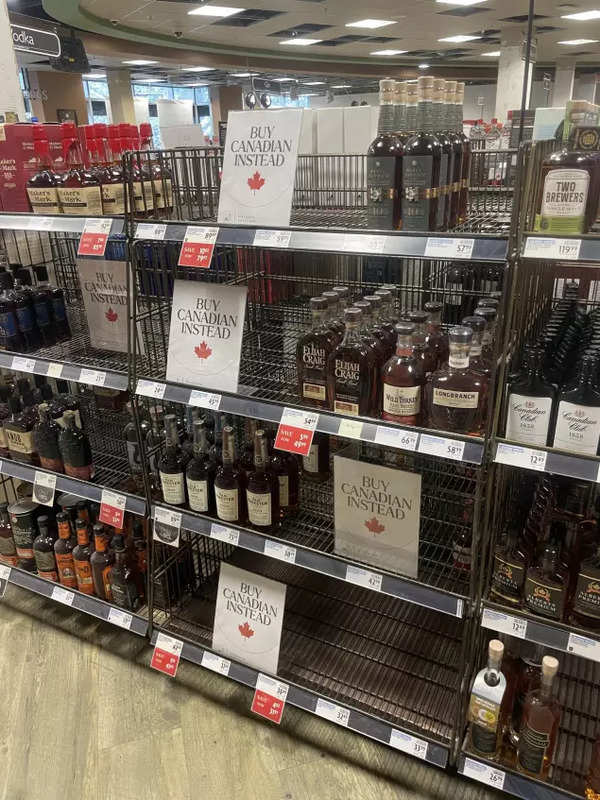

Retaliation has now begun, with Canada, Mexico, and China all announcing counter-measures against US items. Mexico has targeted American-made material, cognac, and cheese products.

Starting February 4, Canada will impose 25 % tariffs on$ 30 billion of US imports. The taxes will apply to products made out of the US, with particular instructions outlined in the CUSMA regulations.

Trump speaks to Trudeau

Trump reportedly contacted Canadian Prime Minister Justin Trudeau in response to the taxes. Given its financial ties to the US, the conversation apparently centered on possible exemptions for Canada. But, no assurances were given. Trump expressed concern about the potential effects of these tariffs on Canadian business, and he warned of a possible response from Canada. Trump, in change, reiterated his position that the taxes are necessary to combat what he called “unfair” business practices.

Stock markets roll

Following the announcement, world stock markets saw a sharp decrease, with US index dropping significantly. Buyers are concerned about the overall financial impact because they fear a trade war will stymie global development. The Dow Jones Industrial Average dropped, and the areas in Europe and Asia even suffered. According to experts, companies that are heavily dependant on goods may experience the most, leading to work costs and rising consumer prices.

American capital standard index, Sensex and Nifty, plunged in first business on Monday, following declines in Eastern markets amid concerns over Trump’s possible tariffs on some of its trading partners. The 30-share BSE Sensex dropped 731.91 items to 76, 774.05, while the NSE Nifty fell 243 items, reaching 23, 239.15.

Even read: Canada, Mexico, China bear the brunt, money floods while global economies see extreme highs

What’s going to be more expensive?

Due to the taxes, prices are anticipated to increase across a wide range of items. Customer gadgets, cars, and agricultural goods top the list. Goods sourced from China, quite as phones, laptops, and home appliances, could notice significant price rises. Also, Mexican imports, including vehicles and food items like avocados, are likely to be more expensive. Retailers have warned that customers will eventually pay for these tariffs, which will increase the cost of regular goods.

Even read: Trump imposes striking tariffs on Canada, Mexico and China

Peso, Chinese American dollar diminish against USD

The dollar index rose 0.11 % to 109.65, reaching a three-week high. Due to tax information, investors ‘ expectations for Federal Reserve price increases have decreased, and this year’s lowering is just 41 foundation points. The US dollar climbed 0.7 % to 7.2552 yuan, while the Mexican peso surged 2.7 % to 21.40. The euro and the Canadian dollar both experienced declines of 1.4 % and 3.3 %. Cryptocurrencies dropped, with Bitcoin falling 4.4 % and Ether dropping 15 %.

‘ Pain may be for it’: Trump

In a speech, Trump acknowledged that the tariffs may cause short-term problems but argued they were necessary to secure long-term financial rewards. ” Will there be some problems? Yes, maybe ( and maybe not! )” Trump said in a blog. However, the article continued,” We does Make America Great Afterwards, and it will all be worth the price that must be paid.”

The” Tax Lobby”, headed by the Globalist, and always bad, Wall Street Journal, is working hard to defend Countries like Canada, Mexico, China, and too many people to brand, continue the centuries long Knockoff OF AMERICA, both with regard to TRADE, CRIME, AND POISONOUS DRUGS that are allowed to so easily flow into AMERICA. THOSE DAYS ARE OVER! The USA has major deficits with Canada, Mexico, and China ( and almost all countries! ), owes 36 Trillion Dollars, and we’re not going to be the” Stupid Country” any longer. MANUFACTURE YOUR PRODUCT IN THE USA WITHOUT TARIFFS! Why should the United States lose billions of dollars in subsidies to other nations, and why should these other nations be willing to pay a fraction of what Americans pay, for instance, for drugs and pharmaceuticals? THIS WILL BE THE GOLDEN AGE OF AMERICA! WILL THERE BE SOME PAIN? YES, MAYBE ( AND MAYBE NOT! ). Despite the fact that we will MAKE AMERICA GREAT AGAIN, IT WILL ALL BE WORTHER FOR THE PURCHASE. A COUNTRY IS RUN WITH COMMON SENSE, AND THE RESULTS WILL BE SPECTACULAR! !

Donald Trump, the president of the United States

Trump’s wider plan to lower the country’s trade deficit and re-establish US manufacturing jobs has been framed by the tariffs. He has urged businesses to relocate their production back to the United States to avoid the higher costs.

US manufacturers raise concerns

American manufacturers are among the hardest hit by the tariffs, particularly those that rely on imported products from China and Mexico. Automobile manufacturers and electronics manufacturers have warned that the higher costs could force them to relocate production or reduce output. Business organizations have urged the Trump administration to reevaluate, contending that while tariffs may offer temporary protection, they could ultimately weaken the economy as a whole. Numerous industry leaders have advocated for negotiations rather than unilateral action.

EU next? Britain spared?

President Donald Trump made the suggestion on Sunday that he would not immediately impose tariffs on Britain, despite the fact that he made it clear that tariffs on the United States, Mexico, and China might apply to the European Union. Trump has waged a trade war to combat trade deficits and address immigration and drug problems. He criticized the EU for its$ 300 billion trade surplus with the US, citing the lack of reciprocal trade in agricultural products and cars. Trump praised Prime Minister Keir Starmer and their fruitful trade dialogue, and suggested a possible solution with the UK.

Business groups call for repeal

Major business organisations, including the US Chamber of Commerce, have strongly opposed the tariffs. They argue that protectionist policies could backfire, leading to higher costs and economic instability. Some trade associations have suggested that tariffs could stifle growth and force small businesses to reduce their size. The strategy may appeal to Trump’s base, but economists have warned that it could alienate allies and harm America’s standing on the global stage. Business leaders are putting pressure on the administration to instead engage in negotiations.

What happens next?

Some analysts think that negotiations between the US and its trade partners could lead to modifications or exemptions. A persistent trade dispute, according to some, could have long-term effects on global markets. Trump has indicated he is willing to negotiate, but he has also threatened to impose additional tariffs on China and Mexico if they don’t comply with US demands.

( With inputs from agencies )