US President Donald Trump has defended his extreme tax policy, insisting he” stands up for Main Street, never Wall Street,” in the face of mounting criticism for plunging markets and international economic unrest.

Trump said in a post on Truth Social,” I’m happy to be the President for the employees, not the outsourcing companies, the President who stands up for Main Street, never Wall Street, defends the middle school, not the social group, and who defends America, never business fraudsters all over the world,” Trump said.

Wall Street’s crazy drive

Trump’s remarks came as US economic industry went through another day of upheaval. After rising by 4.1 percent in early trading on Tuesday, the S&, P 500 quickly lost ground, falling by 3 % before closing down by 1.6 %. The index is currently only 19 % below its peak from February.

After eroding an earlier obtain of 1, 460 points, the Dow Jones Industrial Average ended 320 points lower, down 0.8 %. The Nasdaq Composite dropped 2.1 %.

The intense volatility spread to other international markets, with indices in Shanghai, Paris, and Tokyo posting gains in the morning before analysts issued warnings of additional instability. Much of the conflict is caused by entrepreneur uncertainty regarding how long and how far Trump will go in his trade war.

Taxes are at the centre of financial worry.

Trump’s extensive taxes, which are expected to increase, have stung owners and raised concerns about an economic slowdown. Economists warn that if trade restrictions continue, they may cause a crisis for the US by raising buyer prices and causing disruption to global supply chains. However, agreements may stop the damage with a quick de-escalation.

Trump has shown no evidence of reversing his instructions, even as prominent firm figures and political donors try to influence his decisions in secret.

Company officials face a slog when they hit the wall

Wall Street businessmen and corporate CEOs have made more efforts in recent days to change the president’s trade stance, but they have had little success. Bank executives, including Jamie Dimon of JPMorgan Chase, met with commerce director Howard Lutnick in a closed-door meeting following Trump’s most recent tax statement. According to solutions, Lutnick was unimpressed.

In other instances, GOP megadonors and hedge fund magnates have attempted to influence the White House through names to top advisers, including Treasury Secretary Scott Bessent and Chief of Staff Susie Wiles. These pertains have also failed.

Some economic power brokers have now revealed their emotions in public. William Ackman, a billionaire hedge fund manager, issued a warning on social media that the world economy was being negatively impacted by poor math and called on the administration to reevaluate before” the President makes a huge mistake.”

Oil investor Andrew Hall praised Ackman for speaking out and demanded of another “financial titan” to do the same. Where are the other “financial spartans”? Why don’t they speak away more? posted by.

Wall Street is emitting more cautions every day.

In a text to investors, Dimon claimed that the trade war was already stifling investor confidence and consumer mood, and that it might also stymie economic development. He acknowledged the growing danger, but he avoided making any predictions about a full-fledged downturn.

During an target at the Economic Club of New York, Laurence D. Fink, CEO of funding large BlackRock, was more direct. He warned that the economy is “fragile at this time,” citing also Barbie dolls as examples of looming tariff-related prices.

Fink argued that many Directors think the US may already be experiencing a crisis, underscoring the potential impact of the taxes on the economy if they are still in place.

A change in Trump’s strategy, or no?

There was a speculative wait in tariffs for a short time on Monday, as reports surfaced suggesting a possible pause. That caused a temporary uptick in the market. However, the White House quickly disproven the gossips, and Trump once more reiterated his devotion, sending markets once more to the floor.

By the end of the day, the S&, P 500 was dangerously close to bear market territory, falling another 0.2 %, or nearly 18 %, or mid-February high.

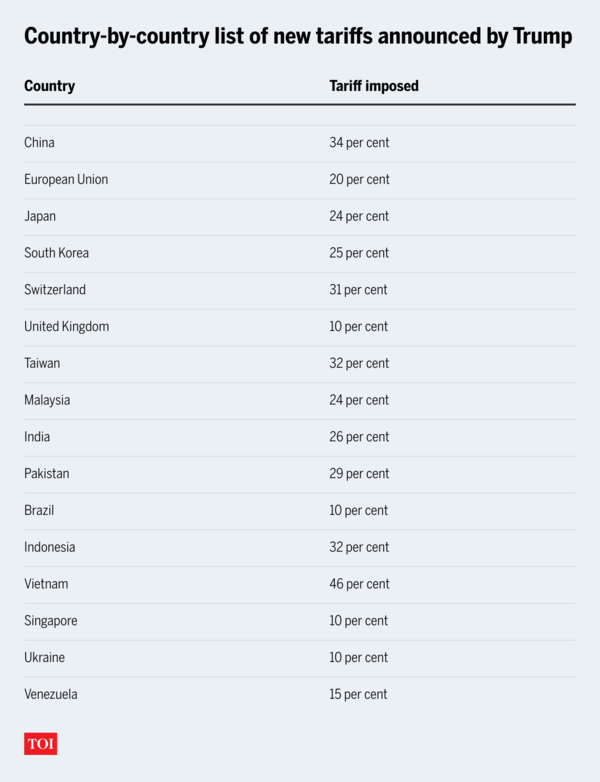

List of new levies that Trump announced country by state listing

White House defends the strategy

White House spokesman Kush Desai stated in a statement that the management is in constant contact with business leaders and the public regarding important policy choices. However, he continued,” The only special interest guiding President Trump’s decision-making is the best interest of the American people,” such as addressing the national emergency posed by our country’s persistent trade deficits.

Trump appears to be standing up for what is happening despite growing pressures to change the course, setting the stage for further hostilities with Wall Street, allies overseas, and possibly economic turbulence.